How Pvm Accounting can Save You Time, Stress, and Money.

How Pvm Accounting can Save You Time, Stress, and Money.

Blog Article

Our Pvm Accounting Statements

Table of Contents4 Easy Facts About Pvm Accounting ExplainedSome Known Factual Statements About Pvm Accounting Pvm Accounting for BeginnersThe Ultimate Guide To Pvm AccountingNot known Incorrect Statements About Pvm Accounting Pvm Accounting Things To Know Before You Buy

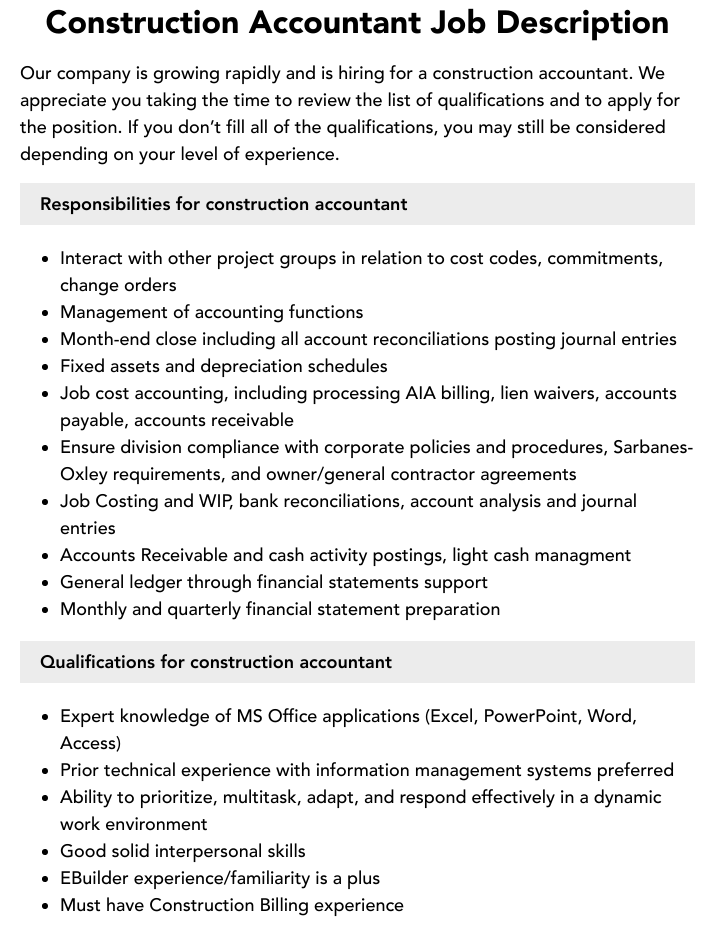

Ensure that the audit procedure conforms with the law. Apply needed building bookkeeping requirements and procedures to the recording and coverage of building activity.Understand and keep typical expense codes in the bookkeeping system. Connect with different funding companies (i.e. Title Business, Escrow Business) concerning the pay application process and requirements required for payment. Handle lien waiver disbursement and collection - https://www.artstation.com/leonelcenteno1/profile. Screen and fix financial institution issues consisting of cost anomalies and check distinctions. Aid with implementing and preserving inner monetary controls and procedures.

The above statements are planned to describe the basic nature and level of job being performed by individuals assigned to this classification. They are not to be construed as an extensive listing of obligations, responsibilities, and skills needed. Personnel might be called for to do obligations outside of their regular responsibilities periodically, as needed.

All About Pvm Accounting

Accel is seeking a Construction Accounting professional for the Chicago Workplace. The Building Accounting professional carries out a range of accounting, insurance policy compliance, and task management.

Principal obligations consist of, yet are not restricted to, handling all accounting features of the firm in a prompt and exact manner and supplying records and routines to the firm's CPA Firm in the preparation of all monetary statements. Makes sure that all audit procedures and functions are handled accurately. Liable for all economic documents, pay-roll, banking and daily operation of the accountancy feature.

Works with Task Supervisors to prepare and publish all monthly billings. Produces monthly Task Cost to Date records and functioning with PMs to fix up with Task Supervisors' budget plans for each project.

More About Pvm Accounting

Effectiveness in Sage 300 Building and Real Estate (formerly Sage Timberline Workplace) and Procore building and construction administration software program an and also. https://dzone.com/users/5145168/pvmaccount1ng.html. Have to likewise excel in various other computer software program systems for the preparation of records, spread sheets and other accountancy analysis that may be needed by monitoring. financial reports. Should have solid business skills and capability to focus on

They are the financial custodians who ensure that construction jobs continue to be on budget, adhere to tax laws, and maintain financial transparency. Building accountants are not just number crunchers; they are tactical companions in the building and construction procedure. Their key role is to manage the monetary elements of building projects, making sure that sources are alloted efficiently and financial risks are lessened.

Everything about Pvm Accounting

They function carefully with project managers to develop and keep an eye on budgets, track expenses, and projection economic requirements. By maintaining a tight grasp on task financial resources, accountants help stop overspending and monetary problems. Budgeting is a cornerstone of effective building projects, and building accountants are important in this regard. They develop comprehensive spending plans that include all project expenditures, from products and labor to permits and insurance coverage.

Building and construction accountants are well-versed in these guidelines and make sure that the job complies with all tax demands. To succeed in the duty of a building and construction accountant, individuals need a solid academic structure in accounting and finance.

Furthermore, qualifications such as Certified Public Accountant (CPA) or Qualified Building And Construction Sector Financial Professional (CCIFP) are highly regarded in the sector. Functioning as an accounting professional in the construction industry features an unique set of challenges. Construction projects typically include limited due dates, altering policies, and unforeseen costs. Accountants should adapt rapidly to these challenges to maintain the job's here are the findings monetary health and wellness intact.

Rumored Buzz on Pvm Accounting

Ans: Building and construction accountants develop and keep an eye on budgets, recognizing cost-saving chances and ensuring that the project remains within budget. Ans: Yes, building and construction accountants take care of tax obligation conformity for building projects.

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make hard options among numerous economic alternatives, like bidding process on one project over one more, selecting funding for materials or devices, or establishing a project's revenue margin. On top of that, building and construction is a notoriously unstable sector with a high failure price, slow-moving time to settlement, and irregular money circulation.

Regular manufacturerConstruction company Process-based. Production entails repeated procedures with quickly identifiable prices. Project-based. Production calls for different procedures, products, and devices with varying prices. Repaired area. Manufacturing or manufacturing occurs in a single (or a number of) controlled places. Decentralized. Each project happens in a new area with varying website problems and distinct obstacles.

7 Simple Techniques For Pvm Accounting

Constant usage of different specialty professionals and providers affects efficiency and cash circulation. Repayment shows up in full or with regular settlements for the complete contract amount. Some portion of settlement might be withheld until project conclusion also when the professional's work is ended up.

While traditional makers have the advantage of controlled atmospheres and optimized manufacturing procedures, construction business should frequently adjust to each new task. Even rather repeatable tasks need adjustments due to site problems and other variables.

Report this page